Managing employee tax and statutory compliance is a critical aspect of any organization's HR operations. At Core HRMS, we understand the complexity and importance of adhering to tax laws and regulatory requirements. That's why we offer a comprehensive HRIS (Human Resource Information System) equipped with an advanced Employee Tax & Statutory Module. Our integrated solution helps you simplify tax management, streamline statutory compliance and ensure accurate reporting, reducing the administrative burden and mitigating compliance risks.

Streamline Employee Tax & Statutory Processes:

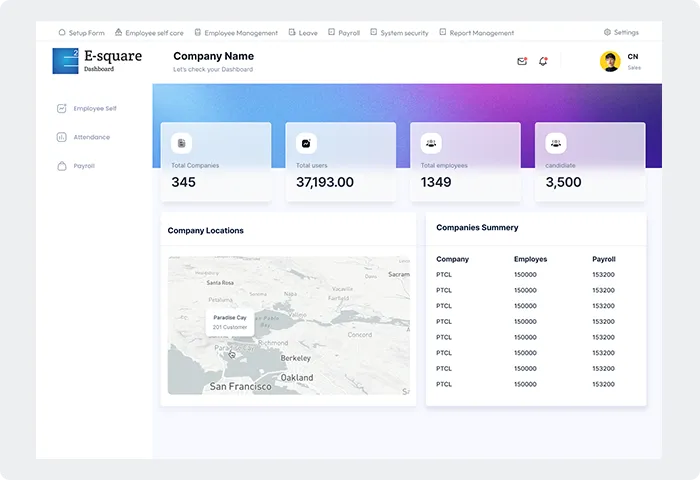

Our HRIS provides a strong Employee Tax & Statutory Module that simplifies and automates various tax-related and statutory compliance tasks. By leveraging this module, you can streamline tax management, generate accurate reports, and ensure compliance with local regulations, all within a centralized platform. Our integrated solution reduces manual errors, saves time and enables your HR team to focus on strategic initiatives.

Key Features of Our Employee Tax & Statutory Module:

Our HRIS enables you to accurately calculate employee taxes based on prevailing tax laws, income brackets, and exemptions. The system automatically withholds the appropriate amount from employee salaries, reducing the risk of errors and ensuring compliance.

Generate comprehensive reports required for statutory compliance, such as tax returns, tax certificates and other relevant documents. Our HRIS automates the process, ensuring accurate and timely submission to the relevant authorities.

Simplify the process of collecting and managing employee income tax declarations. Our HRIS allows employees to submit their tax-saving investments and other relevant details online. The system automates the validation and verification process, ensuring accuracy and compliance.

Stay updated with changes in tax laws and statutory regulations through our HRIS. The system provides alerts and notifications regarding upcoming deadlines, new tax slabs or any regulatory changes that may impact your organization.

Seamlessly integrate with tax authorities' systems for smooth filing and compliance. Our HRIS can directly communicate with tax departments, enabling easy submission of tax returns, employee tax details and other required information.

Simplify employee tax management and statutory compliance with our comprehensive Employee Tax & Statutory Module within our HRIS. Ensure accuracy, reduce manual errors and streamline regulatory requirements with our integrated solution. By leveraging our powerful HRIS equipped with this module, you can streamline tax management, generate accurate reports and mitigate compliance risks.

Contact us today to learn more about how our HRIS can transform your employee tax and statutory processes.